Most people are taught one rule about real estate investing:

If it doesn’t cash flow, don’t buy it.

That rule works in many markets. Vancouver is not one of them.

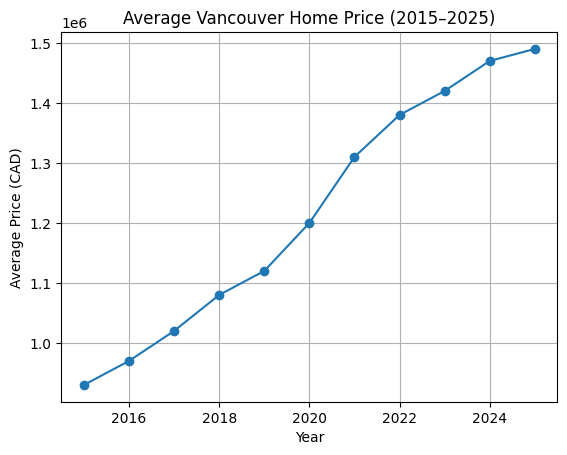

In Vancouver, some of the most successful long-term owners deliberately buy cash-flow negative properties and still come out ahead of the game. The key is understanding why this strategy works here, when it makes sense, and when it absolutely does not. This article breaks down the real math, the real risk, and the Vancouver-specific logic behind cash-flow negative ownership.

What “Cash flow negative” actually means

A property is cash flow negative when:

Monthly expenses > rental income

This typically includes:

- Mortgage Payments

- Property Taxes

- Strata Fees

- Insurance

- Maintenance

- Property management

In Vancouver, the majority of condos and many townhomes are cash-flow negative at today’s prices and interest rates.

That doesn’t automatically make them bad investments. It means the return isn’t coming from rent alone.

Why Vancouver is structurally different from cash-flow markets

Vancouver behaves differently because of three structural realities:

- Land Scarcity – Vancouver is geographically constrained by ocean, mountains, agricultural land reserves, and tight zoning. Land is finite, buildings are not. This pushes long-term appreciation into land-weighted assets, even when short term cash flow is weak.

- Inflation and Leverage Work Quietly in the Background – when you buy a property with leverage (a mortgage), inflation works for you: rent tends to rise over time, wages tend to rise over time, you mortgage payment stays the same. Even if you subsidize the property monthly, the real cost of that subsidy often shrinks over time. Meanwhile: your tenant helps pay down principal and your equity grows invisibly each month. (****This all depends on if you secured the right investment property, in the right area, at the right time. People make poor investment choices all the time powered by emotion and not data that usually screws them over>****)

- Vancouver Buyers Are Competing on Scarcity, Not Yield – in cities like Calgary or Edmonton, investors compete on cap rates, cash flow, and yield. In Vancouver, buyers compete on location, land exposure, zoning, and long term optionality. That is why Vancouver prices don’t behave like spreadsheet driven investment markets.

When Cash-Flow negative properties *can* Make sense

Cash-flow-negative ownership can be strategic when the following boxes are checked:

- You have strong, stable personal income. This strategy assumes you can comfortably cover the monthly shortfall without financial stress. If the negative cash flow feels heavy or emotional, the strategy will fail—even if the math works.

- You’re Buying Long-Term, Not Speculating. Cash-flow-negative properties are not short-term flips. They make sense when you plan to hold 7-15 years, you believe in the long-term fundamentals of Vancouver, and you are not relying on quick appreciation.

- The Property Has Strong Appreciation Drivers. Examples can include: Land Value Exposure, Zoning Upside, Transit-oriented locations, scarcity within its micro market. Not all properties appreciate equally – even in Vancouver.

- The Negative Cash Flow Is Predictable and Contained. A $300-$700 monthly shortfall is very different from large variable expenses, unpredictable data risks, and deferred maintenance bombs. Predictability matters more than perfection.

When cash-flow negative properties are a bad idea

This strategy fails when buyers ignore risk. Avoid cash-flow-negative properties if:

- You’re Stretching Financially. If the property depends on bonuses, commission spikes, lifestyle cutbacks…… it’s not investing. It’s gambling.

- The Property has High Structural Risk. Examples: Weak contingency reserve funds, massive insurance deductibles, poor strata governance, buildings with known envelope issues. Negative cash flow + hidden risk = compounding stress.

- You’re Buying for the Wrong Reason. “Prices always go up” “I don’t want to miss out” “Everyone else is doing it” is NOT a strategy. Cash-flow-negative ownership requires conviction not fear.

Vancouver Specific Examples:

Condos:

- Often cash-flow negative

- Highly sensitive to strata fees ad insurance

- Performance depends heavily on building quality and governance

Some condos outperform. Many do not.

Townhomes:

- Often closer to break-even

- Lower density risk

- Better balance between lifestyle and appreciation

A common “middle ground” strategy.

Detached Homes:

- Typically the most cash-flow negative

- Highest land exposure

- Strongest long-term appreciation profile

This is where the strategy is most intentional – and most misunderstood.

The opportunity cost question (the one most people ignore)

The real question isn’t:

Is this property cash-flow negative?

It’s

What am I doing with this money otherwise?

If the monthly subsidy:

- Replaces rent you’d be paying anyways

- Forces long term savings

- Converts income into leveraged equity

…then the opportunity cost may still favour ownership.

Final thought: this strategy isn’t for everyone – and thats the point

Cash-flow-negatuve investing in Vancouver is boring, long term, and emotionally disciplined. It rewards people who understand risk, patience, and structure, not hype. The goal is not to make every property work. The goal is to know which ones are worth holding through the discomfort.

Thinking about buying or investing in vancouver?

Every situation is different from income, risk tolerance, timeline, and lifestyle. They all matter. If you are considering a purchase and want an honest breakdown of whether a cash-flow-negative property makes sense for you, I am always happy to walk through it with you. No pressure, not sales pitch, just pure honesty and clarity. Work with Taylor Ross Here.